Business Weekly (Zimbabwe)

New framework to attract IFS gazetted

GOVERNMENT has launched a new regulatory framework aimed at establishing the country as a regional hub for international financial services. The Banking (International Financial Services Centre) Regulations, 2025 (SI29 of 2025), gazetted this week,...

Read Full Story (Page 1)Exchange rate premium should drop to 10 pc: CZI

ZIMBABWE should aim for an exchange rate premium of between 10 and 15 percent, the Confederation of Zimbabwe Industries (CZI) says, after noting the 11percentage point decline in the premium between October 2024 and February 2025. The influential...

Read Full Story (Page 1)Zimra targets unregistered businesses with new measures

THE Zimbabwe Revenue Authority (ZIMRA) has begun implementing measures to increase tax compliance among businesses operating without formal registration with the first quarter provisional tax payment due this coming Tuesday. These new tax measures...

Read Full Story (Page 1)NSSA pauses Shava’s appointment as substantive GM

THE National Social Security Authority (NSSA) board has reportedly deferred the appointment of Dr Charles Shava as the substantive general manager of the State-owned pension fund. Sources familiar with the matter said the board was directed to confirm...

Read Full Story (Page 1)TIMB’s new system to counter global tobacco price pressures

THE Tobacco Industry and Marketing Board (TIMB) has started implementing a new price matrix for contract tobacco sales this marketing season that establishes a more representative minimum price by calculating the following day’s minimum based on the...

Read Full Story (Page 1)Exchange rate distortions cost Zim over US$4,5bn

ZIMBABWE’S Treasury may have lost a cumulative US$4,5 billion due to monetary and exchange rate distortions between 2020 and 2023, the World Bank said in a report released this week. The global lender also suggested that without the distortions,...

Read Full Story (Page 1)Zim’s airstrips, paradise for minerals smugglers

ZIMBABWE’S remote airstrips are allegedly being exploited to smuggle precious minerals out of the country, raising concerns about revenue leakages, according to a study by the Southern Africa Resource Watch (SARW) released in January this year. SARW,...

Read Full Story (Page 1). . . CZI casts doubt over RBZ inflation targets

TConfederation of Zimbabwe Industries ( CZI) doubts the central banks can achieve its inflation targets for 2025 following price surges in January, which the business lobby group believes may present significant risks to the bank’s objectives. CZI...

Read Full Story (Page 1)RBZ unveils measures to bolster economy, promote ZiG

THE Reserve Bank of Zimbabwe (RBZ), has announced a raft of measures aimed at strengthening the interbank foreign exchange market, promoting the ZiG currency and fostering a savings culture in the country. These changes, effective immediately, signal...

Read Full Story (Page 1)OK Zimbabwe treading in choppy waters

THE country’s biggest retailer by store numbers, OK Zimbabwe, has plunged into choppy waters, forcing the 83-year old retail chain to immediately shutdown five outlets across the country citing a tough trading environment, which critics, however, argue...

Read Full Story (Page 1)Taxpayers pick up the tab of CBZ loan defaults

ZIMBABWEAN taxpayers are bearing the cost of defaulted agricultural loans extended by CBZ Agro Yield, after a significant number of farmers failed to repay the Government - guaranteed loans, can reveal. According to the latest Zimbabwe Public Debt...

Read Full Story (Page 1)Business expresses frustration over ZIMRA tax demands

SEVERAL local businesses — both private and public — have expressed frustration over the Zimbabwe Revenue Authority’s (ZIMRA) insistence on tax payments despite the significant challenges they face in meeting the obligations due to constraints within...

Read Full Story (Page 1)Relief for struggling businesses

THE Reserve Bank of Zimbabwe (RBZ) has introduced a Targeted Finance Facility (TFF) aimed at addressing liquidity challenges plaguing the banking sector and supporting struggling productive sectors of the economy. This facility, which will be...

Read Full Story (Page 1)Businesses navigate choppy waters in 2024

Zimbabwe’s operating environment has remained largely the same over the years, and industry and businesses have continued to find ways to manoeuvre the difficult space to foster growth and make further investments. In 2024, several issues continued to...

Read Full Story (Page 1)High cost of compliance, informalisation eroding companies’ profits: Mthuli promises to act

Zimbabwe’s high cost of compliance is eroding companies’ profits and incentivising informalisation, hence, the Government should do more to reverse the scenario, business leaders and experts have said. The cost of compliance for businesses is the...

Read Full Story (Page 1)Zim approves US$500m farmer compensation claims

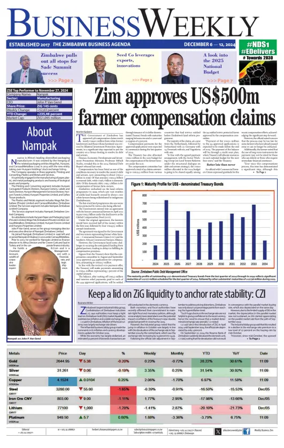

THE Government of Zimbabwe has approved 538 compensation claims worth nearly US$500 million from white former landowners and those whose farmland was covered by Bilateral Investment Protection Agreements, in a significant step expected to put the...

Read Full Story (Page 1)A taxing task: Mthuli’s quest to fill in fiscal void

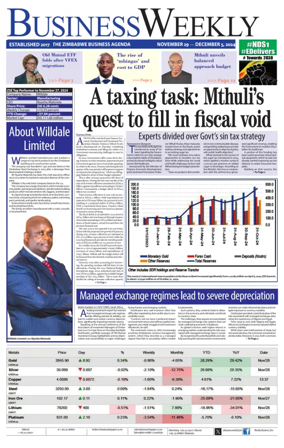

AHEAD of the 2025 fiscal year, Finance, Economic Development and Investment Promotion Minister Professor Mthuli Ncube faced a daunting task on Thursday: revitalising Zimbabwe’s economy and filling the coffers of a Government encountering challenges to...

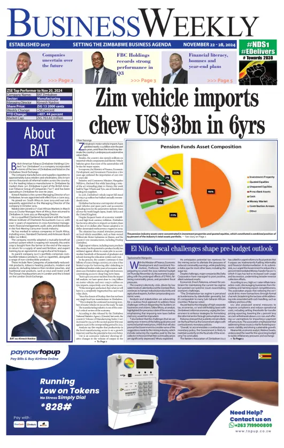

Read Full Story (Page 1)Zim vehicle imports chew US$3bn in 6yrs

Zimbabwe’s motor vehicle imports have gobbled nearly US$ 3 billion over the past six years, amid fears the trend may decimate the country’s underpressure automotive value chain. Besides, the country also spends millions on imported vehicle components...

Read Full Story (Page 1)ZiG scarcity pushes currency to 11pc gain in five days

THE local currency, the Zimbabwe Gold (ZiG), has been steadily appreciating against the US Dollar this week, recording its first-ever positive run since its devaluation in September 2024. The new currency opened the month trading at ZiG 28,6829 per...

Read Full Story (Page 1)RBZ holds inflation projections steady, but analysts defy

THE Reserve Bank of Zimbabwe (RBZ) has come under scrutiny over its inflation projections, with the apex bank insisting the monthly inflation rate, which soared to 37,2 percent in October from 5,8 percent the previous month, will soon cool down. This...

Read Full Story (Page 1)‘Govt must keep tight lid on fiscal spending for stability’

ZIMBABWE should maintain a tight grip on fiscal discipline to ensure macroeconomic stability going forward, amid a projected strong economic rebound next year after a difficult 2024 that has been throttled by an El Nino-induced drought, according to...

Read Full Story (Page 1)New land policy fit for purpose, BAZ

THE local banking sector has expressed optimism about the new land ownership policy Government announced last week that brings significant changes to land tenure system and the broader agricultural landscape, describing it as “fit for purpose.” The...

Read Full Story (Page 1)Zig devaluation crushes incomes

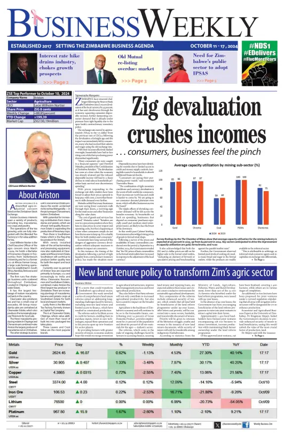

ZIMBABWE faces renewed challenges following the Reserve Bank of Zimbabwe (RBZ)’s recent devaluation of the local currency by 43 percent, as it has sent shockwaves through the economy, squeezing consumer disposable incomes, further dampening consumer...

Read Full Story (Page 1)PAYE tax can shore up ZiG demand — CZI

THE Confederation of Zimbabwe Industries (CZI), a powerful business lobby group for manufacturers, has called for the inclusion of pay-as-you-earn (PAYE) among statutory payment obligations that can be settled in Zimbabwe Gold (ZiG) to drive its demand...

Read Full Story (Page 1)‘Bold measures, not tinkering can save ZiG’

THE hemorrhaging Zimbabwe Gold (ZiG) needs wholesale policy interventions, including measures to address structural deficiencies to rescue the domestic currency from total collapse, economic analysts have warned. This comes as the fledgling domestic...

Read Full Story (Page 1)Urgent interventions needed to prop up ZiG

THERE is need for urgent interventions to prop up the faltering Zimbabwe Gold (ZiG) in the wake of its rapid depreciation on the black market, which has prompted its widespread rejection in the economy and caused pricing nightmares for registered...

Read Full Story (Page 1)WBWS system fails to address forex, exchange rate challenges

BUSINESS and economic analysts have called for the Reserve Bank of Zimbabwe (RBZ) to adopt a truly market-driven exchange rate, arguing the current Willing-Buyer-Willing-Seller (WBWS) system, despite its purported market-based nature, is still a...

Read Full Story (Page 1)Unilever Zim exit: Failure to innovate or economic challenges?

AFTER nearly eight decades of operating in Zimbabwe, Unilever, one of the multinational consumer goods giants, reportedly announced its intention to pull out of the country by the end of the year, joining other foreign-owned firms exiting the African...

Read Full Story (Page 1)Industry calls for measured approach to de-dollarisation

GOVERNMENT has to listen to economic actors and analyse trends in the market in order to create a market — determined transition that is ideal to foster confidence and eventual de-dollarisation that does not stand the risk of being rejected, according...

Read Full Story (Page 1)Austerity measures back on table as Govt seeks to balance books

THE Government has outlined a raft of measures including increased taxation, asset sales and the issuance of new securities in order to plug off the projected 2025 budget deficit. In 2025, Government expects to generate ZiG103,17 billion in revenue,...

Read Full Story (Page 1)Govt breaks GMB monopoly, touts ZMX

THE Zimbabwean Government has overhauled the grain marketing system, shifting from the long-standing monopoly held by the Grain Marketing Board (GMB) to a commodity exchange — a structured environment where prices are determined by supply and demand...

Read Full Story (Page 1)Low investment in R & D stunting Sadc industrialisation

THE Southern African Development Community (SADC) faces significant hurdles in achieving its industrialisation goals due to insufficient investment in research and development (R& D), according to the bloc’s secretariat. Despite launching the SADC...

Read Full Story (Page 1)IPEC to crack down on non-compliant pension funds

Insurance and Pensions Commission ( IPEC) boss, Commissioner Dr Grace Muradzikwa, has vowed to leave no stone unturned in ensuring that pension funds comply with Statutory Instrument ( SI) 162 of 2023. The outlines the framework for compensat SI ing...

Read Full Story (Page 1)Probe exposes chrome export ‘heist’ in Zim

Ameticulously planned chrome heist orchestrated by corrupt border officials, is reportedly bleeding millions from Zimbabwe’s economy after an investigation unearthed some irregularities in the country’s chrome exports, Business Weekly can reveal. As...

Read Full Story (Page 1)Casualties unavoidable as liquidity challenge persists

LOCAL businesses are in a quandary as it emerged limited access to finance for working capital requirements will have severe consequences on them such as the downsising of operations and carnage on jobs. Several manufacturers and businesses are...

Read Full Story (Page 1)Sugar tax bites into demand, hikes production costs

ZIMBABWE’S beverage makers are reeling under pressure from the recent introduction of a sugar tax on beverages, which has slowed demand across various categories and increased production costs. Initially, Finance, Economic Development and Investment...

Read Full Story (Page 1)