Your Money

Street where one half pays twice as much

Hazelbourne Road, in Clapham, southwest London, appears to be an ordinary street with terraced red-brick houses sitting neatly behind trimmed green hedges. Yet households on one side of the street pay almost £1,000 more in council tax than their...

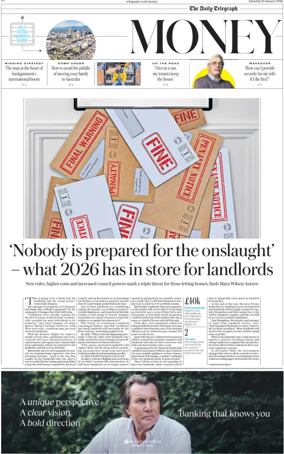

Read Full Story (Page 1)‘Nobody is prepared for the onslaught’ – what 2026 has in store for landlords

‘This is going to be a bleak year for landlords and the rental sector,” warns Katie Burgess. She manages 15 properties in Liverpool, and thinks that “nobody is prepared” for the onslaught of changes that 2026 will bring. “Landlords were already...

Read Full Story (Page 1)How to invest in 2026

Stock markets defied expectations by hitting record highs last year – yet investors could be forgiven for feeling nervous as we enter 2026. The AI bubble failed to pop in 2025, as some experts had predicted, but there is still no shortage of warnings...

Read Full Story (Page 1)The terrifying cost of owning a home in Labour’s Britain

As Rachel Reeves was laying the ground for her ‘ mansion tax’, she wheeled out a favourite maxim of the Left: it was time for the wealthy to “pay their fair share”. To address what she considered a “longstanding source of inequality”, the Chancellor...

Read Full Story (Page 1)State pension is latest victim of two-tier Britain

Division – or a perception of it – ripples throughout many facets of British society, from policing and the justice system to the chasm between private and public sector workers. One aspect of civic life that has – until now – escaped the “twotier”...

Read Full Story (Page 1)Don’t save. Don’t set up a business. Don’t work to buy a nice house. Don’t get a pay rise. Don’t send your children to private school. Don’t aspire.

Rachel Reeves’s Budget sent a clear message to the strivers paying Britain’s bills. Starting a business doesn’t pay. Saving is a mug’s game. Getting promoted isn’t worth it. The Chancellor’s smorgasbord of tax rises this week was aimed in large part...

Read Full Story (Page 1)How Reeves could come after your home

For millions of families, their home is their most important financial asset – and the one to which they are emotionally most attached. Yet it now seems certain that the embattled Chancellor will unveil a raid on the property wealth of middle...

Read Full Story (Page 1)Your localprop tis ert y ho m w ar o ke H t?

House prices in nearly three quarters of neighbourhoods in England and Wales have fallen in real terms, Telegraph Money analysis has revealed. Across the country, property prices have increased by 18pc in the past four years, while inflation has soared...

Read Full Story (Page 1)‘Cash Isa raid is seriously unfair to pensioners’

Chris Chatwin has been a prudent saver all his life, predominantly by investing money in the stock market. “In my family, saving for retirement and unexpected events has always been important,” he said. “When I was in my twenties and thirties, and my...

Read Full Story (Page 1)Why retirees should access Isas and tax-free lump sums before pension savings

income tax. A more popular option is “pension drawdown”, which is where you keep your money invested and make regular or ad-hoc withdrawals whenever you like. The major benefit is you can keep investing the remainder of your fund, which means it can...

Read Full Story (Page 2)Reform’s guinea pig council in crisis

When Reform won control of Kent, wiping out the Tories in one of their strongest rural heartlands, Nigel Farage called it a “tectonic shift in British politics”. Linden Kemkaran, the newly elected Kent county council leader, promised to offer the...

Read Full Story (Page 1)The motorists fighting back against Britain’s private car parks

John Batten had no problem affording the £170 fine that landed on his doorstep. It was a matter of principle that he refused to pay. The 66- year- old pensioner had been embroiled in a six-month battle with private parking company Excel over a...

Read Full Story (Page 1)‘It was like a horror movie’: Airbnb host’s home hijacked by scammers

When Nargiz Kazimova met her Airbnb guest, Yanni, last November, her first impression of the diminutive Chinese woman was of a “very timid and shy girl”. Little did she know that as she handed over the keys to her Canary Wharf flat, she would set in...

Read Full Story (Page 1)Protect your pension from the Budget

With the Government seeking ways to fill a potential £50bn black hole in Britain’s public finances, there may, in the words of crooner Nat King Cole, “be trouble ahead”. While Rachel Reeves, the Chancellor, has pledged to “get the balance right” at...

Read Full Story (Page 1)The great pensions spending spree

Savers plundered a record £71bn from their pension pots last year in an attempt to shield their retirements from Rachel Reeves, analysis shows. Figures from the Financial Conduct Authority (FCA) show pension withdrawals surged by almost £20bn in the...

Read Full Story (Page 1)Britain’s public sector pension albatross now at £6 trillion

Britain owes almost £6tn in gold-plated public sector pensions and no money has been set aside to pay for them, analysis shows. Retirees will receive almost £57bn this year alone, most of which comes from generous final salary schemes that were...

Read Full Story (Page 1)Why Reeves’s attack on downsizers would wreck the housing market

Chancellor Rachel Reeves has to find £ 50bn to plug the Government’s black hole, and one way to raise as much money as possible would be to target property. Weeks of speculation over potential new taxes on homeowners have revealed that downsizers...

Read Full Story (Page 1)‘My tax adviser told me to sell my business and leave the country’

I ‘have been told to leave the country,” says Steve Perez, founder of Global Brands, a drinks business he started in 1997. “My tax adviser said: ‘ You need to go’.” Perez is one of Britain’s embattled family business owners who are being advised to...

Read Full Story (Page 1)Why it no longer pays to earn £100k

Earning over £100,000 used to be a hallmark of success. Not so much any more. These days, workers on six-figure salaries can be left thousands of pounds worse off thanks to our warped tax system. Those earning between £100,000 and £125,140 face the...

Read Full Story (Page 1)HMRC sacks dozens of staff who snooped on taxpayers

Fifty workers were sacked by HM Revenue and Customs last year for breaking data privacy rules and snooping on taxpayers’ records. In total, 354 tax employees have been disciplined for data security breaches since 2022, of whom 186 have been fired,...

Read Full Story (Page 1)How consumers will pay the price of desperate Reeves’ deregulation

Labour made no secret of wooing businesses ahead of the general election last year, promising to cut red tape in order to boost economic growth. However, the Government’s deregulation drive since coming into power has rung alarm bells with consumer...

Read Full Story (Page 1)‘Locals don’t want our second homes’

The second home council tax premium has “decimated” local property markets, with house prices falling and the number of homes for sale soaring. The policy was supposed to make properties more affordable for those living there by encouraging second...

Read Full Story (Page 1)What to expect in this year’s Budget

Anaemic growth and higher-than- expected government borrowing will be weighing on Rachel Reeves as MPs head off on their six-week summer recess. The Chancellor will not be able to avoid questions about how she is going to address the economic hole the...

Read Full Story (Page 1)Is it time to leave St James’s Place?

St James’s Place will introduce its much-anticipated new charging structure next month, reducing costs for some clients, but others will still be subject to its controversial exit charge for six years. Britain’s biggest wealth manager, which has long...

Read Full Story (Page 1)Should you insure against the risk of inheritance tax?

Paul Hiatt is spending hundreds of pounds a year on life insurance to protect his children’s inheritance from falling into the clutches of Rachel Reeves. Hiatt first took out a policy eight years ago but was forced to take another deal out shortly...

Read Full Story (Page 1)A year of Labour: the winners and losers

It is one year since Labour’s “loveless landslide” and already millions of individuals, and the economy, are suffering. Last summer, Rachel Reeves ominously declared the Tories had left Britain with a £22bn “black hole” in the public finances. It was...

Read Full Story (Page 1)Private schools forced to raise fees 17pc

Private school fees will rise by more than 17pc in the forthcoming academic year thanks to a “triple whammy” of Labour tax hikes, Telegraph analysis shows. The average Year 13 day fees will jump from £21,035 to £24,600 between September 2024 and...

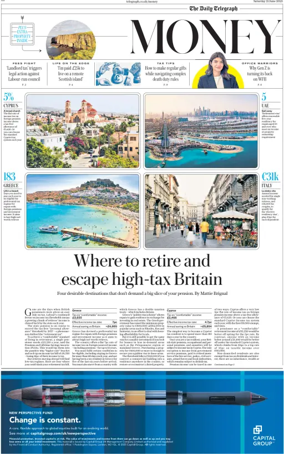

Read Full Story (Page 1)Where to retire and escape high-tax Britain

Gone are the days when British pensioners were given an easy ride on tax. Labour’s continued freeze on income tax thresholds means a growing chunk of retirees’ income is clawed back by the state each year. The state pension is on course to exceed the...

Read Full Story (Page 1)Is means testing the state pension next?

As Rachel Reeves announced an about-turn on her winter fuel policy this week, she opened a whole new can of worms for pensioners. The Chancellor’s decision to return the payments to those with an income of under £35,000 has created a complicated means...

Read Full Story (Page 1)Reform wages war on public sector pensions

AReform government would overhaul gold-plated public sector pensions to stop them bankrupting Britain. Richard Tice told Telegraph Money he would put everything on the table and end the taxpayer “rip- off ” if his party won the next general...

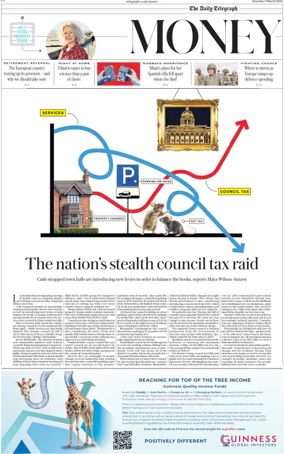

Read Full Story (Page 1)Revealed: the places where more than half of council tax goes on pensions

Cash- strapped local authorities are spending more than half of their council tax revenue on staff pensions, a Telegraph Money investigation has found. The Shetland Islands council puts the equivalent of 111pc of its council tax haul into staff...

Read Full Story (Page 1)Savings are lost cause under Labour

Common sense dictates that saving is a good idea, in order to provide security and a better life for you and your family. However, anyone living in Britain today would be forgiven for thinking there is no longer much point. A leaked memo has revealed...

Read Full Story (Page 1)No income tax: how Britain could thrive

When we think of tax, the first one that comes to mind is probably the chunk that evaporates from our pay cheques. Taxpayers have been handing over a slice of their income to the state since 1799 when William Pitt the Younger brought in the levy to pay...

Read Full Story (Page 1)Farage: Scrap second home tax raids

Hundreds of second home owners in Reform UK councils could be spared double tax bills after party leader Nigel Farage labelled the policy “madness”. Reform’s local election success last week saw the party gain more than 600 councillors and take control...

Read Full Story (Page 1)The great middle-class tax squeeze

Being middle class isn’t what it used to be. Social signifiers such as accents and sensibilities may have stayed broadly the same for decades, but when it comes to money in your pocket, class boundaries are becoming blurred. Wages in Britain are...

Read Full Story (Page 1)Cruel rule that threatens your pension

Final salary pensions, offering guaranteed, inflation-proof payments for life, have long been the holy grail of retirement. In a country where one in six retirees already live in poverty, and millions of workers heading the same way, they could also...

Read Full Story (Page 1)Labour’s unprecedented tax raid on our pensions

Former Labour chancellor, Gordon Brown, was accused of ruining retirement for millions when he scrapped a valuable tax relief for pension schemes in his first Budget. The move, which was not mentioned in New Labour’s election manifesto, cost employers...

Read Full Story (Page 1)‘I saved £2.8m pension from Trump’

Days before Donald Trump’s inauguration in January, Christopher Mellor made a radical decision. The 65-year-old financial coach pulled his and his wife’s pensions from the stock market and moved the money into cash savings accounts. The couple, from...

Read Full Story (Page 1)Why the second home council tax racket must end

When Michael Gove first announced a raft of sweeping reforms to tackle the “scourge” of second- home owners in 2023, his intention was to “bring life back” to popular seaside towns such as those in Cornwall and Devon. Few could have predicted that two...

Read Full Story (Page 1)‘I’ve bought a Ferrari to avoid Rachel Reeves’s inheritance tax grab’

Steve Perez didn’t really want to buy a new Ferrari. He wanted to invest the money in his £30m drinks and hotel business instead. But Rachel Reeves’s inheritance tax raid has turned financial planning into a hall of mirrors. The Chancellor has slapped...

Read Full Story (Page 1)Tax grab to destroy second home dream

Mag Humphreys does not consider herself a typical second- home owner. The 71-year- old inherited a four-bedroom bungalow in Rock, Cornwall, along with her four siblings after their parents passed away two years ago. The property was built by her...

Read Full Story (Page 1)The pitfalls of trying to avoid IHT

Elderly homeowners are ripping equity out of their homes in the hope of avoiding Rachel Reeves’s inheritance tax raid – but experts warn it is leaving them worse-off. In the autumn Budget, the Chancellor froze inheritance tax thresholds and made...

Read Full Story (Page 1)The nation’s stealth council tax raid

Local authorities are imposing a barrage of stealth costs on residents despite rocketing council tax bills, Telegraph Money can reveal. Cash-strapped councils are increasingly targeting households, drivers and tourists, as well as introducing new...

Read Full Story (Page 1)Storm Rachel is set to wreck your finances

Britain is usually well prepared for April showers. But this year the nation faces a different phenomenon – Storm Rachel. The first week of April will see many of the measures announced in Rachel Reeves’s maiden Budget coming into force. Households...

Read Full Story (Page 1)The great public sector pensions shambles leaving lives in limbo

More than 100,000 public servants have seen their retirement planning plunged into chaos by bungling pension schemes. NHS workers, teachers, soldiers and civil servants have been hit with unexpected tax bills, delays to divorces and opaque pension...

Read Full Story (Page 1)How to protect your savings from a tax raid

For years, the humble cash Isa has been a savings haven, with millions of pounds stowed away in these accounts safe in the knowledge that the interest earned will be shielded from tax. But now, the future of the cash Isa has been put into question....

Read Full Story (Page 1)How retirees are dodging death tax

Wealthy retirees are buying bigger houses and funding their grandchildren’s school fees to avoid paying Rachel Reeves’s pension death tax. The Chancellor announced in her first Budget that inheritance tax will be applied to pensions from April...

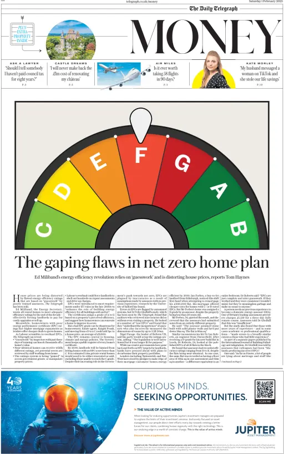

Read Full Story (Page 1)The gaping flaws in net zero home plan

House prices are being distorted by flawed energy efficiency ratings that are based on “guesswork” by poorly trained assessors, The Telegraph has been told. Ed Miliband, the Energy Secretary, wants all rental homes to meet adequate efficiency ratings...

Read Full Story (Page 1)How Labour’s ‘bonkers’ pension death duty risks killing retirement savings

It has been a decade since pensions became a haven from the taxman. In 2015, George Osborne, Conservative chancellor at the time, removed the 55pc levy on unused pension funds at death and transformed retirement pots into tools to transfer wealth down...

Read Full Story (Page 1)Gold-plated pensions paid by councils

Thousands of retired council workers are receiving pensions of more than £ 50,000 a year and hundreds are scooping six- figures, a Telegraph Money investigation has found. Local authorities have been struggling to balance the books for years, but...

Read Full Story (Page 1)The pension trap ruining retirements

Millions of pensions are still at risk of haemorrhaging money close to when savers need them most, a Telegraph Money investigation has found. Savers have been repeatedly warned that bond market chaos could wreck their retirements if their pension has...

Read Full Story (Page 1)How Labour’s tax raid threatens to end the middle-class private school dream

Sending children to private school was once a cornerstone of upper-middleclass aspiration. But parents’ ability to afford it has been slipping away for years. And as Labour’s VAT raid forces schools to raise fees by an average of 14pc, it could sound a...

Read Full Story (Page 1)How to give this Christmas – and beat the taxman while you are at it

It is the season of giving, which means many of us will be donating to good causes over the festive period. The British public is expected to give over £2.8bn to those in need this November and December, according to research by the Charities Aid...

Read Full Story (Page 1)Six decades of stockpicking secrets

It may seem strange to describe The Telegraph’s stockpicking column Questor as a public service, but in researching 60 years of this mystical byline I have found there is little that is more apt. The column is meant to be a valuable guide to the...

Read Full Story (Page 1)Why the property market is in trouble

For more than 20 years, Britain’s property market soared. Average house prices have risen from £85,000 in 2000 to £ 291,000 today, a 342pc increase, according to the Office for National Statistics. But the party may be coming to an end. Optimistic...

Read Full Story (Page 1)Labour’s big council tax lie

Labour has been accused of misleading voters after promising not to raise council tax and claiming residents paid more under the Conservatives. Ministers this month paved the way for council tax to rise by an average of £110 next April. It comes after...

Read Full Story (Page 1)Millions more face inheritance hit

The most reached-for defence of inheritance tax is that it only affects a tiny fraction of the population. All criticism is, therefore, overblown. After all, as Rachel Reeves pointed out when delivering her maiden Budget last month, just 6pc of estates...

Read Full Story (Page 1)Your pension death tax questions answered

Rachel Reeves’s bombshell Budget has forced families to hurriedly rethink their financial plans. The most significant changes, due to take effect in April 2027, are to inherited pensions. Telegraph Money has been inundated with emails and letters from...

Read Full Story (Page 1)Protect your pension from death tax hit

One of the biggest shocks from Labour’s first Budget came when Chancellor Rachel Re eve s announced that pensions will become subject to inheritance tax. The move reverses the decision by George Osborne in 2015 to exempt pension pots from being...

Read Full Story (Page 1)Labour’s bloodbath Budget: where will the axe fall?

After just weeks in office, Rachel Reeves announced there was a £ 22bn black hole in Britain’s finances. Placing the blame squarely on the Conservatives, the Chancellor warned of “tough decisions” ahead. It sparked rushed financial decisions from a...

Read Full Story (Page 1)Chancellor’s capital gains raid condemned by savings giants

Arise to capital gains tax risks pushing a generation of investors to extinction, Britain’s biggest stockbroker has warned. The Government is thought to be on the verge of raising capital gains tax rates in the Budget as part of a £40bn plan to shore...

Read Full Story (Page 1)Landlords face wipeout under Labour

Landlord profits have collapsed in the past decade following an onslaught of taxes and red tape, analysis reveals. Today, Telegraph Money is launching a campaign calling on the Government to end the war on property investors and put a stop to any...

Read Full Story (Page 1)How Labour’s flagship private school tax plot is fast unravelling

Labour has been steadfast in its ambition to tax private schools fees, but cracks are appearing in the Government’s flagship policy. Indeed, critics are suggesting that the VAT raid is not worth the hassle involved to raise the £1.5bn a year Labour...

Read Full Story (Page 1)The heavy price of Miliband’s eco quest

Ed Miliband’s net zero drive could cost landlords, housing associations and taxpayers up to £ 36bn, Telegraph analysis reveals. The Energy Secretary this week said he will ban landlords from letting out properties that are not energy efficient,...

Read Full Story (Page 1)