BusinessMirror

BSP: GEOPOLITICAL RISKS TO REQUIRE RCEP ACTION

MEMBER economies of the Regional Comprehensive Economic Partnership (RCEP) should “proactively manage” geopolitical risks to safeguard regional integration as heightened tensions in the global arena reduce goods trade and cross-border investments,...

Read Full Story (Page 1)2026 REVENUE TARGETS CUT ON SLOWER GROWTH

THE government has cut its revenue target for this year after lowering its economic growth outlooks, as slower activity is expected to drag on collections and overall fiscal performance. This adjustment was revealed to reporters on Thursday after...

Read Full Story (Page 1)BIR PREPS FOR RETURN OF LOA, VOWS REFORMS

THE Bureau of Internal Revenue (BIR) is moving closer to resuming its issuance of letters of authority (LOAS) as reforms are under way to improve the system. In a statement on Wednesday, the BIR said it rolled out its five-point priority reform...

Read Full Story (Page 1)BOP SWINGS TO DEFICIT AS IMPORTS RISE IN ’25

THE $5.7-billion deficit in the Philippines’s balance of payments (BOP) in 2025, a reversal of the $609-million surplus posted in 2024, can be attributed to importdriven demand, weaker exports and investment flows in recent months, according to...

Read Full Story (Page 1)IMF CUTS PHL GROWTH OUTLOOK FROM ’25 TO ’27

THE International Monetary Fund (IMF) sees the “slower pace” of capital accumulation to drag Philippine economic growth until 2027, according to IMF’S World Economic Outlook (WEO) Update. Based on the report, IMF slashed its growth projections for the...

Read Full Story (Page 1)ANOTHER ‘SILENT CRISIS’

WHILE key learning activities at home are crucial to support early learning and brain development, the findings in the Second Congressional Commission on Education’s (EDCOM II) Final Report showed that less than half of Filipino households with young...

Read Full Story (Page 1)11-MONTH REMITTANCES EXPAND 3.2% TO $32.11B

THE Philippines is set to post another record high in cash remittances from overseas Filipinos in 2025, with inflows reaching $32.11 billion from January to November, as favorable foreign exchange rates boost sending power. Latest data from the Bangko...

Read Full Story (Page 1)‘WAIT-AND-SEE’ STANCE: FDI INFLOWS DIP TO $642M

FOREIGN direct investment (FDI) inflows into the Philippines plunged to $642 million in October 2025, as investors adopted a “wait-and-see” stance amid global trade risks and domestic political developments. Data from the Bangko Sentral ng Pilipinas...

Read Full Story (Page 1)‘TOURISM REVIVAL KEY TO REVVING UP GDP’

BUSINESSMEN belonging to the Filipino Chinese Chambers of Commerce and Industry Inc. (FFCCCII) are prodding the government to implement “comprehensive” tourism reforms to revive what it deems as the “lowhanging fruit” sector. FFCCCII made the...

Read Full Story (Page 1)SEA OF FAITH

Amid chanting, swaying bodies and the relentless press of the faithful, thousands of barefoot devotees reached for the andas (carriage) of the Black Nazarene as the centuries-old image inched its way back to Quiapo Basilica during the annual Traslación...

Read Full Story (Page 1)END-NOV N.G. DEBT HITS ₱17.647-T RECORD HIGH

OUTSTANDING debt of the national government reached a new record high of P17.647 trillion as of the end of November 2025, as the state incurred more obligations amid a stronger peso. Latest data from the Bureau of the Treasury (BTR) showed that the...

Read Full Story (Page 1)GEOPOLITICS IMPACT TO HURT MOVE VS. INFLATION

THE country’s former chief economist warned that a stronger dollar, owing to ongoing geopolitical conflicts, will hurt government efforts to tame inflation. “Moving forward, the country’s inflation rate will be affected by the current political...

Read Full Story (Page 1)PBBM SIGNS ’26 BUDGET, VETOES ₱92B IN U.A. ITEMS

AMID protests from some groups on the growing unprogrammed appropriations (UA) by Congress, President Ferdinand Marcos Jr. has trimmed it down by at least P92 billion, making the P6.793-trillion General Appropriations Act (GAA) leaner or “pork-free,”...

Read Full Story (Page 1)11-MO N.G. DEBT SERVICE GROWS 3.58% TO ₱2.02T

THE national government has paid P2.024 trillion for some of its debts from January to November 2025, up 3.58 percent from the P1.954 trillion paid in the 11-month period in 2024, data from the Bureau of the Treasury (BTR) showed. The bulk, or 60.46...

Read Full Story (Page 1)GROUPS URGE PBBM: VETO PORK IN BUDGET

THE Roundtable for Inclusive Development (RFID) and the People’s Budget Coalition (PBC) on Thursday urged President Ferdinand Marcos Jr. to veto what it called “shadow pork” in the form of unprogrammed appropriations worth P243 billion. The groups...

Read Full Story (Page 1)GROSS BORROWINGS UP TO ₱2.596T IN JAN-NOV

THE Marcos Jr. administration is nearly done with its 2025 borrowing program, after gross borrowings rose to P2.596 trillion in the first 11 months of the year, according to latest data from the Bureau of the Treasury (BTR). The government’s total...

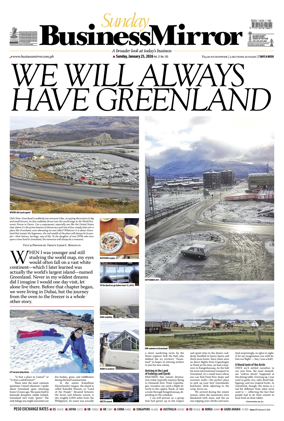

Read Full Story (Page 1)PRINTING PROSPERITY

As 2026 begins, an owner of a screen-printing shop in Quezon City prepares orders for calendars, planners, and corporate giveaways, reflecting the busy season for businesses and households alike. The new year marks the Year of the Fire Horse in the...

Read Full Story (Page 1)BSP SEES DEC INFLATION RANGING FROM 1.2-2.0%

FOOD and fuel prices, driven by lingering weather disruptions and strong holiday demand, are expected to push up inflation in December, according to the Bangko Sentral ng Pilipinas (BSP). In its month-ahead inflation forecast, the BSP said the...

Read Full Story (Page 1)Q4 INFRASPEND TO STAY LOW FROM DPWH RESET

LOWER infrastructure spending will further pull down government disbursements for the remainder of the fourth quarter, as the Department of Public Works and Highways (DPWH) addresses corruption issues and validates projects before construction...

Read Full Story (Page 1)PHL BOP DEFICITS TO HIT $6.2B IN ’25, $5.9B IN ’26

PERSISTENT trade-in-goods gap and weaker services receipts will push the Philippines’ balance of payments into deficits in 2025 and 2026, reversing last year’s surplus, according to the Bangko Sentral ng Pilipinas (BSP). Based on BSP’S estimates, the...

Read Full Story (Page 1)BUDGET GAPS SHRINKS 26% TO P157.6B IN NOV

THE national government’s budget deficit tapered to P157.6 billion in November on more careful spending amid the flood control scandal to prevent the risk of corruption. Latest data from the Bureau of the Treasury (BTR) showed the budget gap was...

Read Full Story (Page 1)9-MONTH EXTERNAL DEBT SERVICE BURDEN DIPS 21%

THE country paid less for its external debt in the first nine months on the back of lower principal repayments, according to the Bangko Sentral ng Pilipinas (BSP). Latest BSP data showed the country’s external debt service burden (DSB) decreased to...

Read Full Story (Page 1)FROM POWERPOINT TO PRODUCT

PHILIPPINE tourism, long hailed as a pillar of national development, is struggling to regain its footing in the post-pandemic era. Despite robust domestic travel and renewed investor confidence, the sector remains constrained by outdated laws, symbolic...

Read Full Story (Page 1)BUSINESS IS CONFIDENT,P25.00 PUBLIC NOT SO–BSP

DESPITE business sentiment improving on hopes of higher holiday-driven spending, Filipino consumers turned more pessimistic as concerns over corruption, inflation and income pressures dampened their confidence, according to the Bangko Sentral ng...

Read Full Story (Page 1)THINK TANK: ECONOMIC GROWTH TO HIT 4.6% IN Q4

LOWER inflation, increased OFW remittances and exports, lower interest rates and a rebound in government spending are seen to propel the Philippine economy by 4.6 percent in the fourth quarter of 2025, according to UA&P’S Market Call report. “We...

Read Full Story (Page 1)BSP RULES ON FINANCIAL INTERMEDIARIES TWEAKED

GOVERNMENT financial institutions, international lenders and entities operating through agency agreements or managed funds will now be treated as financial intermediaries under new Bangko Sentral ng Pilipinas (BSP) rules. BSP issued Circular No. 1224...

Read Full Story (Page 1)ILO: PHL MAY MISS GREEN TRANSITION QUALITY JOBS

THE Philippines risks missing out on higher quality jobs from the global just transition as its nickel industry remains largely focused on raw ore exports, according to a new International Labour Organization (ILO) brief on Tuesday. The ILO said the...

Read Full Story (Page 1)‘YOU CAN CALL ME’

OVERSEAS Filipino workers (OFWS) shoulder the hidden tolls of migration, including cultural displacement, homesickness, exhausting work schedules, and the constant responsibility of supporting their families financially, pressures that can quietly sap...

Read Full Story (Page 1)DOLE: Rise in jobless rate due to natural disasters

THE Department of Labor and Employment (DOLE) has pinned the rise in October’s unemployment figures on the recent natural calamities that hit the country. In a text message, DOLE Secretary Bienvenido E. Laguesma said the storms and earthquakes that...

Read Full Story (Page 1)AMID SLOWING GROWTH, JOBLESS RANKS EXPAND

HOLIDAY hiring barely offered a seasonal nudge as October’s jobs data showed the labor market straining to absorb new entrants amid a cooling economy. On Wednesday, the Philippine Statistics Authority (PSA) reported that the labor force expanded by...

Read Full Story (Page 1)PHL GROWTH LIMITED TO 5.5% TILL 2027—WB

LOWER domestic investment, weak business confidence and a significant decline in foreign direct investments will cause the Philippine economy to post growth of below 5.5 percent until 2027, according to the World Bank. In a media briefing on Tuesday,...

Read Full Story (Page 1)11-MO BOI INVESTMENTS DOWN BY NEARLY HALF

INVESTMENTS approved by the Board of Investments (BOI) plunged to P817 billion in the January to November 2025 period, nearly 50 percent down from the P1.58 trillion approved in the 11-month period in the same period a year ago. In a statement, the...

Read Full Story (Page 1)GROSS RESERVES AMPLE FOR 7-MO IMPORTS—BSP

RECORD-HIGH gold holdings pushed the country’s gross international reserves (GIR) to a 13-month high as of end-november, according to the Bangko Sentral ng Pilipinas (BSP). Preliminary BSP data showed the GIR inched up 0.75 percent month-on-month to...

Read Full Story (Page 1)THE WORK OF ‘MAMA RANGER’ IS NEVER DONE

QUANG NIH PROVINCE, Vietnam—the recent approval of all seven proposals for stronger shark and rays protection by the majority of the parties in the recent 20th Conference of the Parties to the Convention on International Trade in Endangered Species of...

Read Full Story (Page 1)NOV INFLATION AT 1.5%, 11-MO AVERAGE IS 1.6%

THE slower increase in prices of food and nonalcoholic beverages, particularly vegetables and meat, led to the easing of inflation in the country to 1.5 percent in November 2025. According to the Philippine Statistics Authority (PSA), the inflation...

Read Full Story (Page 1)PESO BREACHES ₱59:US$1 AMID RATE CUT TRACKING

THE Philippine peso once again touched the P59-level per US dollar on Thursday, hitting a two-week low on market expectations of a monetary easing by the Bangko Sentral ng Pilipinas (BSP) and domestic pressures. The peso closed at P59.02 to the US...

Read Full Story (Page 1)WITH SLOW ’25 GROWTH, DEC RATE CUT HELD LIKELY

THE Bangko Sentral ng Pilipinas (BSP) signaled that a December rate cut is increasingly likely as it expects the economy to slow in 2025 amid waning investor confidence. Speaking to reporters on Wednesday, BSP Governor and Chairman of the Monetary...

Read Full Story (Page 1)10-MO DEBT HITS ₱17.56T AS PESO KEEPS SLIPPING

THE weaker peso against the US dollar drove the national government’s outstanding debt to P17.562 trillion by the end of October, as currency swings added to its obligations despite a lesser reliance on foreign borrowings. Latest data from the Bureau...

Read Full Story (Page 1)GROSS BORROWINGS DIP 32.1% TO ₱87.81B IN OCT

THE government’s gross borrowings dropped sharply in October amid a steep decline in external financing, even as domestic debt uptake remained on the rise. Latest data from the Bureau of the Treasury (BTR) showed gross borrowings slumped by 32.07...

Read Full Story (Page 1)‘NUKE’ IT: PLASTIC WASTE RECYCLING GETS A BOOST

LOCAL scientists are optimistic that radiation-enabled recycling hubs will support Philippine industries in creating circular value chains by converting plastic waste into construction-grade materials for infrastructure projects. Speaking at the...

Read Full Story (Page 1)S&P AFFIRMS PHL CREDIT RATING, BUT FLAGS RISKS

STANDARD & Poor’s (S&P) Global Ratings affirmed its longterm “BBB+” and “A-2” short-term sovereign investment-grade credit ratings and maintained its positive rating outlook on the Philippines. In a report, S&P Global Ratings affirmed the Philippines’...

Read Full Story (Page 1)75.9% BUDGET SURPLUS GROWTH A ‘BAD’ SIGNAL

THE national government logged a “bad” kind of budget surplus in October, as both revenue collection and spending declined due to cautious spending by the state—a response to the massive outcry over alleged corruption in flood control projects. Latest...

Read Full Story (Page 1)DOUBLE BLOW: TARIFFS, FLOOD FUNDS FALLOUT

THE Philippines faces a double blow as the flood control corruption scandal erodes investor confidence while the United States’ reciprocal tariffs begin biting into exports, according to BMI, a unit of Fitch Solutions. In its latest outlook for the...

Read Full Story (Page 1)‘FOREX TWEAKS ONLY IF MARKET’S GOING CRAZY’

PANGLAO, Bohol—the Bangko Sentral ng Pilipinas (BSP) will only intervene in foreign exchange when the markets behave irrationally or when there is excessive speculation, according to BSP Governor Eli M. Remolona Jr. “We don’t always intervene. We’re...

Read Full Story (Page 1)PHL PESO HITS ALL-TIME LOW, BUT ‘STILL STABLE’

THE Philippine peso weakened to an all-time low of P59.17 against the US dollar on Wednesday, weighed down by local governance issues and strong global demand for the greenback. The peso lost 18.5 centavos against the dollar when it opened at P58.95....

Read Full Story (Page 1)BSP EYES 24/7 REAL-TIME RTGS TO SPUR PAYMENTS

THE Bangko Sentral ng Pilipinas (BSP) has urged payment system stakeholders to establish a 24/7 real-time gross settlement (RTGS) system to support round-the-clock financial transactions and cross-border payments. In the 2025 Peso RTGS Forum, BSP...

Read Full Story (Page 1)8-MO NET FDI INFLOWS PLUNGE 22.5% TO $5.2B

NET foreign direct investments (FDI) inflows have fallen by double digits both in August 2025 and in the first eight months of the year due to a mix of trade uncertainties and local political noise that weighed on investor sentiment. Latest data from...

Read Full Story (Page 1)10-MO GIR HITS $109.7B AMID CURRENCY WARS

THE country’s dollar reserves climbed to $109.7 billion as of the end of October this year, providing defenses against external shocks and speculative attacks on the local currency. Preliminary data from the Bangko Sentral ng Pilipinas (BSP) showed...

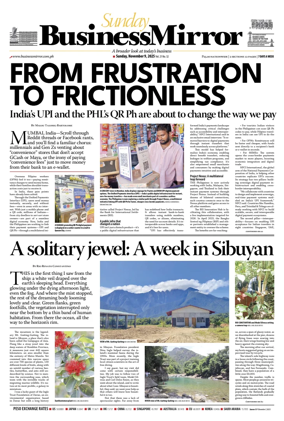

Read Full Story (Page 1)FROM FRUSTRATION TO FRICTIONLESS

MUMBAI, India—scroll through Reddit threads or Facebook rants, and you’ll find a familiar chorus: millennials and Gen Zs venting about “convenience” stores that don’t accept Gcash or Maya, or the irony of paying “convenience fees” just to move money...

Read Full Story (Page 1)INFRA FIASCO’S IMPACT: Q3 GROWTH A MERE 4%

THE worse-than-expected infrastructure corruption scandal coupled with muted household spending dragged the Philippine economy to its slowest pace since the pandemic. On Friday, the Philippine Statistics Authority (PSA) announced that the Philippine...

Read Full Story (Page 1)WEATHER-TRIGGERED PRICE HIKES SEEN MILD

DESPITE recent typhoons, the country’s inflation is expected to remain largely steady in the coming months, with weather-related price surges expected to be mild and short-lived, economists said. The Philippine Statistics Authority (PSA) reported on...

Read Full Story (Page 1)GRADUAL, FLEXI-TARIFF ON RICE STARTS JAN ’26

AMORE gradual and flexible tariff adjustment on rice shall be adopted starting January 1, 2026 depending on the change in international prices, according to the Economy and Development (ED) Council chaired by President Ferdinand R. Marcos Jr., the...

Read Full Story (Page 1)‘WEAK INDUSTRY, INFRA MESS, JITTERS HURT GDP’

THE performance of the Philippine industry, alongside infrastructure scandals and global uncertainty, may have dragged down the growth of the Philippine economy in the third quarter of 2025, according to Department of Economy, Planning, and Development...

Read Full Story (Page 1)CHARTING THE PHL’S MARITIME FUTURE

FOR an archipelago like the Philippines, the sea is both lifeblood and barrier—thousands of kilometers of beautiful and majestic coastlines simultaneously connect and divide the nation. More than two decades ago, that division felt more real than the...

Read Full Story (Page 1)HOMEGROWN HERO

FILIPINO golf standout Miguel Tabuena has done the unimaginable—winning the International Series Philippines presented by Bingo Plus in dominant fashion. Even with major champions and Asia’s best in the field, Tabuena not only held his nerve, he showed...

Read Full Story (Page 1)PESO BACK AT ₧58 LEVEL; PROFIT-TAKING NOTED

THE Philippine peso rebounded on Wednesday, back at P58 levels after slipping past P59, as profittaking persisted and seasonal dollar inflows picked up ahead of Undas and the start of holiday-related spending. The local currency closed at P58.69 to...

Read Full Story (Page 1)AMID TURMOIL, PHL WILL STEER ASEAN WELL: PBBM

KUALA LUMPUR— Likening the chairmanship of the 2026 Association of Southeast Asian Nations (ASEAN) Summit to captaining a ship in turbulent waters, President Ferdinand Marcos Jr. has vowed to steer the regional bloc to peace through pragmatism and...

Read Full Story (Page 1)‘GOOD GOVERNANCE CAN BLUNT DISASTER IMPACT’

AS the Philippines may not be able to escape its fate as the world’s most disasterprone nation, good governance can turn the tide to resilience and growth, according to economists. In a commentary by New Yorkbased think tank Globalsource Partners,...

Read Full Story (Page 1)WIDER MARKETS, SUPPLY CHAIN FROM ASEAN DEALS

KUALA LUMPUR— Malacañang said the newly signed Association of Southeast Asian Nation (ASEAN) Trade in Goods Agreement (ATIGA) and the ASEAN-CHINA Free Trade Area (FTA) 3.0 will open the regional bloc to emerging industries with Beijing and boost...

Read Full Story (Page 1)LEFT BEHIND BY HISTORY:

AS they walked up to the thick metal pillars of the border wall dividing Tijuana and San Diego, the Hussaini siblings carried nothing from their lives in Afghanistan than a hazy fantasy of what awaited them on the other side. Amir, 21, and his...

Read Full Story (Page 1)HIGHLAND HARMONY

In a dazzling display of culture and color, the Cordillera’s version of the Aliwan Festival marked its fourth year with street dancers from Baguio City, Benguet, Ifugao, Apayao, Kalinga, Mountain Province, Abra, and Tabuk filling Session Road with...

Read Full Story (Page 1)NG’S BUDGET GAP HITS ₧1.117T FOR 9 MONTHS

THE national government’s budget deficit expanded to P1.117 trillion as of the end of September, but still came in lower than the fiscal program. Latest data from the Bureau of the Treasury (BTR) showed the shortfall increased by 15.15 percent to...

Read Full Story (Page 1)GROWTH TO SLOW IN Q3 ON STORMS, FUND MESS

WEATHER disturbances and the flood control mess will slow down economic growth in the third quarter but will likely pick up in the last quarter of the year due to lower inflation rate, more OFW remittances and “steady” export gains despite the...

Read Full Story (Page 1)ASSET RECOVERY ‘SOON’ IN FLOOD FUNDS THEFT

“CONCRETE actions” on the flood control investigation are expected to unfold in the next few weeks, particularly in recovering the assets of those involved in the multibillion corruption mess, according to Public Works and Highways Secretary Vivencio...

Read Full Story (Page 1)JITTERS, TRADE GAP CITED IN YR-TO-DATE BOP GAP

THE country’s balance of payments (BOP) posted a surplus in September, as modest inflows from the Bangko Sentral ng Pilipinas’s (BSP) income abroad and the national government’s foreign currency deposits narrowed the yearto-date deficit. Latest data...

Read Full Story (Page 1)‘FLOOD CONTROL CRISIS MAY FORTIFY ECONOMY’

SETBACKS caused by corruption allegations hounding flood control projects and other public infrastructure projects are temporary and will not derail the Philippines’s bid to achieve higher growth, according to the country’s socioeconomic planning...

Read Full Story (Page 1)WORLD IS SHRINKING FOR PHL EXPORTERS

THE number of Philippine businesses dealing with global trade has continuously dwindled through the years due to inadequate budgets, shifts to the domestic market, and, lately, the uncertainty stemming from protectionist policies such as the...

Read Full Story (Page 1)SUPPLY SHOCKS TO SPUR ‘A BIT OF A SLOWDOWN’

THE country’s socioeconomic planning chief sees “a bit of a slowdown” in the economy in the third quarter of 2025 due to supply shocks such as typhoons and work suspensions. “There may be a bit of a slowdown because of the supply shocks that we have...

Read Full Story (Page 1)BIR TARGETS BIG ONLINE FIRMS FOR TAX EVASION

THE Bureau of Internal Revenue (BIR) will run after large-scale online businesses suspected of underreporting sales, with tax evasion charges to be filed against those proven to have dodged taxes. In a televised news program on Thursday, Romeo D....

Read Full Story (Page 1)AUG, 8-MO REMITTANCES UP, SEEN RISING FURTHER

THE steady stream of cash remittances into the country from overseas Filipinos continues to support households, with inflows expected to rise further as families recover and prepare for more disasters. According to the latest data from the Bangko...

Read Full Story (Page 1)‘FUND MESS SPOOKED’ ‘A’ CREDIT RATING BY S&P

THE Philippines could have finally clinched an “A” credit rating from Standard & Poor’s (S&P) Global this year, but the alleged corruption in the government’s flood control projects derailed the upgrade, Finance Secretary Ralph G. Recto has...

Read Full Story (Page 1)GOCC SUBSIDIES SLIDE BY 19.27% IN JAN-AUG

SUBSIDIES provided by the national government to government-owned and -controlled corporations (GOCCS) declined in January to August. Latest data from the Bureau of the Treasury (BTR) showed that subsidies to state-run firms plunged by 19.27 percent...

Read Full Story (Page 1)LIGHT IN THE RUBBLE

CAIRO—TWO years into the war in Gaza, and as Israel and Hamas reached a deal raising hopes for the end of the conflict, Associated Press photographer Fatima Shbair looked back at some of her most poignant images. Shbair has seen conflict and violence...

Read Full Story (Page 1)