StarBiz

COVER FEATURE

Malaysia is estimated to attract about Us$40bil (Rm162bil) in data centre (DC) investments by 2030. The spike in DCS is alarming, with some government officials taking a second look at matters. Should a moratorium be imposed? Is a bubble in the making?

Read Full Story (Page 2)Growth forecast to cool in 2026

KUALA LUMPUR: The economy may be heading into a slower growth phase this year, but Ambank Group chief economist Firdaos Rosli says the moderation reflects a “normalisation” after last year’s front-loading boost rather than a sharp downturn, with...

Read Full Story (Page 1)Strata overhang to ease if prudence continues

KUALA LUMPUR: The property overhang situation could ease further if more developers adopt a cautious approach and be more discerning in their launches. A growing number of property developers have taken more proactive steps in recent times to conduct...

Read Full Story (Page 1)Charting next growth phase with ROAR30

KUALA LUMPUR: Malayan Banking Bhd (Maybank) has unveiled its new five-year strategy, ROAR30, which will focus on delivering shareholder value through continued improvements in the lender’s return on equity (ROE). The strategy, which will run until...

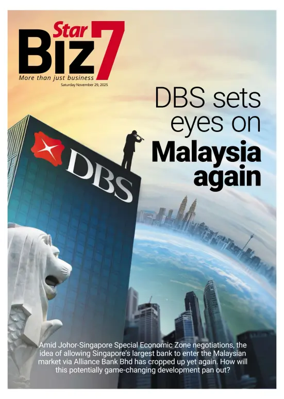

Read Full Story (Page 1)Alliance Bank confident of standalone growth

KUALA LUMPUR: Alliance Bank Malaysia Bhd has assured investors that it is well-positioned to grow independently and organically, while denying knowledge of any potential merger and acquisition (M&A) exercise. Its chief executive officer Kellee Kam...

Read Full Story (Page 1)Ringgit strength to be short-lived

PETALING JAYA: Optimism surrounding the ringgit may be short-lived, with Maybank Investment Bank Bhd expecting the currency to weaken in the second half of financial year 2026 (2H26) amid a stabilising US dollar and shifting global market...

Read Full Story (Page 1)Is a bull run in the pipeline?

PETALING JAYA: The “sell America” trade and improved investor sentiment looks likely to support Bursa Malaysia in the immediate future as the local benchmark plays catch-up to regional markets. The money moving into banks like Malayan Banking Bhd,...

Read Full Story (Page 1)Kinergy powers up

PETALING JAYA: Kinergy Advancement Bhd is emerging as a new name in Malaysia’s independent power producer (IPP) space. Having built its reputation as a clean energy contractor, the group is now pushing deeper into asset ownership, including by...

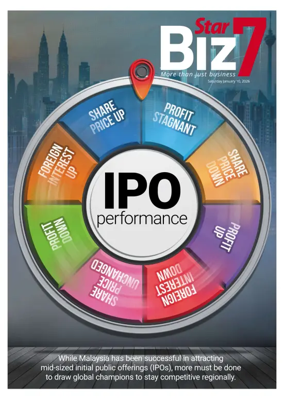

Read Full Story (Page 1)COVER FEATURE

Bursa Malaysia had a banner year for listings in 2025, chalking up 60 debuts – the most in over a decade – and nearly Rm30bil in fresh market capitalisation, though initial public offering proceeds eased to Rm6bil. Finance Minister II Datuk Seri Amir...

Read Full Story (Page 2)Data centre hype meets reality

PETALING JAYA: The local data centre play is drawing closer scrutiny, as policymakers reassess its broader economic impact while industry players flag mounting financial risks. Treasury secretary-general Datuk Johan Mahmood Merican said the government...

Read Full Story (Page 1)Confidence booster

PETALING JAYA: Malaysia’s latest reforms and relief measures outlined by Prime Minister Datuk Seri Anwar Ibrahim in his New Year message are expected to support business sentiment, consumer spending and economic growth in 2026, economists and analysts...

Read Full Story (Page 1)Growth trajectory intact

PETALING JAYA: Malaysia has the right economic policy mix to face global headwinds in 2026. However, medium and long-term measures, economists said, should be adopted to ensure it has sufficient ammunition to weather the challenges in the event the...

Read Full Story (Page 1)COVER FEATURE

The year 2026 will be a decisive economic test for Prime Minister Datuk Seri Anwar Ibrahim. With the next election in view, Malaysians are increasingly focused on income growth, cost of living and job security. Looking ahead, execution will matter more...

Read Full Story (Page 2)Ringgit rally likely to place pressure on VM26 goals

PETALING JAYA: A stronger ringgit may be good for imports and help lower costs of inputs for domestic businesses, but may not necessarily work to the tourism industry’s favour, when looking at Thailand’s case, where a combination of a stronger baht and...

Read Full Story (Page 1)FBM KLCI ends 2025 on firmer footing

PETALING JAYA: The Malaysian stock market ended 2025 on firmer footing, even as foreign fund outflows and external macroeconomic uncertainties lingered through much of the year. This was supported by a strengthening ringgit, economic growth and easing...

Read Full Story (Page 1)Can Bursa’s outperformers stay ahead?

PETALING JAYA: As the broader market navigated a year marked by shifting interest-rate expectations, currency volatility, and policy resets, performances on Bursa Malaysia were far from uniform. Selected sectoral indices – such as plantation,...

Read Full Story (Page 1)Building momentum across sectors

PETALING JAYA: While real estate experts remain largely optimistic about the outlook of the property market in 2026, they expect the year to see its fair share of outperformers and strugglers. Zerin Properties chief executive officer Previn Singhe...

Read Full Story (Page 1)COVER FEATURE

If 2025 was a marathon, Bursa Malaysia lagged behind, with the FBM KLCI posting just a 2% gain. Analysts warn 2026 could be similar unless corporate performance and market appeal improve to attract investors. A firm ringgit, attractive market...

Read Full Story (Page 2)Foreign funds set to U-turn into Bursa

PETALING JAYA: After enduring a bruising year in 2025, with net withdrawals by foreign investors crossing Rm21bil, the Malaysian stock market may be heading into a better year. Analysts are growing more optimistic that foreign funds will return to...

Read Full Story (Page 1)Import-heavy sectors to gain from stronger ringgit

PETALING JAYA: The ringgit’s rally against the greenback is expected to boost profit prospects for import-heavy domestic industries, while weighing on exporters through adverse currency translation. The ringgit climbed to another new high at...

Read Full Story (Page 1)M&A activity set to soar in 2026

PETALING JAYA: The domestic mergers and acquisitions (M&A) landscape is set to see more deals flowing into 2026 compared to 2025, as global trade tensions ease and investors set their sights on South-east Asia, including Malaysia. Technology-related...

Read Full Story (Page 1)LIFESTYLE

Alan Howard planted a flag in Abu Dhabi in 2023, the opening act of his eponymous hedge fund’s campaign to win over the United Arab Emirates’ deep-pocketed investors. Between setting up with just 15 people in Abu Dhabi and growing that number 10-fold,...

Read Full Story (Page 2)Aussie high for Gamuda

PETALING JAYA: Gamuda Bhd capped the year with a significant expansion of its Australian footprint after securing three major infrastructure and energy-related contracts worth a combined Rm10.7bil, pushing the group’s outstanding order book to a record...

Read Full Story (Page 1)Top Glove ramps up competitiveness

PETALING JAYA: Top Glove Corp Bhd, the world’s largest rubber glove manufacturer, believes its cost-control initiatives have lowered expenses to the extent that it is now on par and competitive with Chinese producers. In fact, said group executive...

Read Full Story (Page 1)FBM KLCI tipped for rebound in 2026

PETALING JAYA: After a bruising 2025 marked by heavy foreign outflows and policy uncertainty, Malaysia’s equity market is shaping up for a more constructive 2026, anchored by improving earnings visibility, resilient domestic demand and undemanding...

Read Full Story (Page 2)Higher loan growth likely in 2026

PETALING JAYA: Amid the tough operating environment, exacerbated by tariff uncertainties, global trade risk and geopolitical tensions, the banking sector is poised to remain on a strong footing heading towards 2026. With the country’s relatively...

Read Full Story (Page 1)COVER FEATURE

Malaysia’s retail grocery and convenience store sector may appear simple on the surface, but it is a fiercely competitive, crowded space that rewards only the most capable operators. Despite strong investor interest driven by its cash-generating model,...

Read Full Story (Page 2)REITS to gain from rate cuts

PETALING JAYA: While the US Federal Reserve (Fed) had surprised few with its third 25-basis-point (bps) rate cut this year, experts diverged on whether asset rotation into Malaysian real estate investment trusts (REITS) due to the lower fund rates is a...

Read Full Story (Page 1)AI, digitalisation to drive tourism industry

KUALA LUMPUR: Players within the tourism sector are gearing up for Visit Malaysia 2026 (VM2026), buoyed by rising optimism across the industry. While Covid-19 had once dealt a major blow to the sector, stakeholders now believe that tourism numbers are...

Read Full Story (Page 2)Bond inflows to sustain

PETALING JAYA: Appetite for Malaysian debt securities is seen to be sustained on a strong and favourable outlook, anchored mainly by expectations of potential cuts to the United States’ interest rates. Foreign interest into the local debt market is...

Read Full Story (Page 1)Cautious outlook for manufacturing sector in 1H26

PETALING JAYA: Economists are positive on the country’s manufacturing activities as the year ends, but some are taking a cautious stance towards this trend moving into the first half of next year due to looming headwinds. The electrical and...

Read Full Story (Page 1)PERSPECTIVES

The framework is there, the updates are rolling out, and with the right mix of policy, innovation, and maybe a few solar panels, Malaysia could soon hit “run” on a fully sustainable data ecosystem. What’s left is implementation to catch up with the...

Read Full Story (Page 2)Ringgit to hold firm into next year

PETALING JAYA: Economists and foreign exchange (forex) watchers continue to be bullish on the prospects of the ringgit heading into 2026, as the local note strengthened to RM4.11 against the US dollar yesterday, its strongest level in more than 14...

Read Full Story (Page 1)Large foreign fund outflow temporary situation

PETALING JAYA: As foreign fund outflows from the stock market crossed Rm20bil in just 11 months of 2025 (11M25), analysts have warned the selling spree may well continue into next year. As it stands, foreign investors have been largely net sellers of...

Read Full Story (Page 1)Steady showing set to continue

PETALING JAYA: After an overall in-line third quarter (3Q25) results season, Malaysia’s corporate earnings are expected to improve quarter-on-quarter (q-o-q) in 4Q25, with analysts projecting steady earnings growth. Looking further ahead, analysts...

Read Full Story (Page 1)Gains likely this month

PETALING JAYA: As the dust settles on the just concluded third-quarter earnings season, the FBM KLCI is seen to be able to sustain much of its gains moving forward as the year closes. An even clearer picture could emerge eventually in the final...

Read Full Story (Page 1)Corporate gains lift sentiment

PETALING JAYA: Corporate results for the third quarter ended September (3Q25) have ignited optimism for sustained positive momentum heading into the new year, but analysts remain cautious about the outlook of the companies listed on Bursa...

Read Full Story (Page 1)COVER FEATURE

Singapore officials are urging for DBS Group Holdings Ltd, the country’s largest bank, to build a stronger presence in the Johor– Singapore Special Economic Zone to support Singaporean companies operating there. As a result, discussions between both...

Read Full Story (Page 2)Sime Darby’s 1Q26 revenue at Rm18bil

PETALING JAYA: Sime Darby Bhd expects its diversified portfolio will continue to show its resilience as geopolitical and trade tensions keep business conditions subdued. The conglomerate noted its UMW division could stand out amid headwinds in some...

Read Full Story (Page 1)Alliance Bank posts highest earnings in 13 quarters

PETALING JAYA: Alliance Bank Malaysia Bhd’s shares hit the highest level in more than three months after it announced its strongest net profit in 13 quarters, amid renewed market talk that Singapore’s largest bank may likely emerge as a major...

Read Full Story (Page 1)TM posts strong profit growth in 3Q

PETALING JAYA: Telekom Malaysia Bhd (TM) expects to close 2025 on a steady footing, heading into the final quarter with a priority on protecting profitability while investing strategically in future-ready infrastructure. Group chief executive officer...

Read Full Story (Page 1)Cheery 4Q in store

PETALING JAYA: The retail sector is set to close the fourth quarter (4Q) on a high, supported by strong festive shopping, year-end promotions, holiday travel and improved tourist arrivals. Typically “the strongest quarter” for the retail industry,...

Read Full Story (Page 1)Compromise plan crucial

PETALING JAYA: An abrupt implementation of Sabah’s right to 40% of net revenue derived from the state could likely be detrimental for Malaysia – a country that has already been navigating budget deficits for 28 straight years. Economists also warned...

Read Full Story (Page 1)CPO output set to beat target

PETALING JAYA: Malaysia’s crude palm oil (CPO) production for this year could surpass the Malaysian Palm Oil Board’s (MPOB) earlier forecast of 19.5 million tonnes, following unexpectedly strong output in October, according to director-general Datuk...

Read Full Story (Page 1)IPI for September comes in stronger

PETALING JAYA: The shifting sands of global trade will continue to affect Malaysia’s exports outlook and impact overall economic growth going into 2026. This is despite the better-than-expected industrial output for September as measured through the...

Read Full Story (Page 1)Robust earnings likely in 3Q

PETALING JAYA: The upcoming financial reporting season for the third quarter of 2025 (3Q25) is anticipated to see solid performances from property developers, underpinned by strong sales registered during that period. RHB Investment Bank analyst Loong...

Read Full Story (Page 1)CAPITAL MARKETS

Thailand’s industrial estate sector is poised for strong growth in the coming years. This optimism is fuelled by a sharp rise in foreign direct investment as the country cements its position as a key alternative hub to China. The implication is clear:...

Read Full Story (Page 2)OPR retained at 2.75%

PETALING JAYA: After months of cautious language and watchful patience, Bank Negara Malaysia’s (BNM) latest statement hints at a gradual shift in tone, one that changes from wary to quietly more hopeful. The 10-member Monetary Policy Committee (MPC)...

Read Full Story (Page 1)SD Guthrie’s nine-month earnings top Rm2bil mark

PETALING JAYA: Plantation giant SD Guthrie Bhd believes crude palm oil (CPO) prices will be supported in the coming weeks by expectations of tighter supply, as the industry enters a seasonally low output cycle. Despite palm oil’s narrowing price...

Read Full Story (Page 1)IOI Corp to focus on improving yields

PUTRAJAYA: IOI Corp Bhd is exploring plans to turn portions of its aged plantation land into large-scale solar farms, as the palm oil producer looks to diversify its earnings base and boost its renewable energy portfolio. The company has identified...

Read Full Story (Page 1)Rates likely to remain unchanged

PETALING JAYA: The overnight policy rate (OPR) is likely to remain at the current level of 2.75%. This is so given that there are high expectations that gross domestic product (GDP) growth this year would be able to hit at the upper end of the...

Read Full Story (Page 1)Resilient loan growth

PETALING Despite a tough economic environment, Malaysian banks are expected to weather the headwinds and show resiliency next year, thanks to the sector’s healthy asset quality, strong provisions, and robust capitalisation. Banking experts said...

Read Full Story (Page 1)COVER

Last month, the Hire Purchase (Amendment) Bill 2025 was passed, abolishing Rule of 78 and flat interest rates for hire purchase loans. The market has welcomed the change, calling it long overdue. The Rule of 78 burdened borrowers by charging higher...

Read Full Story (Page 2)Capital A on track for PN17 exit in December

KUALA LUMPUR: Capital A Bhd has cleared a key hurdle to be lifted out of its Practice Note 17 (PN17) status by the end of this year. This is following all conditions required for the disposal of its airline business to its sister company Airasia X Bhd...

Read Full Story (Page 1)Cautious optimism outlines 3Q results season

PETALING JAYA: Domestic demand and tariff clarity are key factors that could anchor improved third-quarter (3Q25) performance for companies listed on Bursa Malaysia, analysts say, as the corporate results season beckons. Notably, the early release of...

Read Full Story (Page 1)M&A deals to gain momentum

KUALA LUMPUR: The plantation sector will likely see more privatisation or merger and acquisition (M&A) deals moving into 2026, analysts say. Maybank Investment Bank (Maybank IB) Research noted that M&A activities in the industry have gained momentum...

Read Full Story (Page 1)US trade deal brings certainty and strain

PETALING JAYA: Economists say the newly formalised trade agreement with the United States brings much-needed clarity and certainty for exporters and investors, even as it opens the door to greater competition for local producers. They noted that while...

Read Full Story (Page 1)Gold’s glitter continues

PETALING JAYA: Gold prices are expected to remain bullish and rise to the US$5,000 per-ounce mark next year despite the recent technical correction and profit-taking following a record-breaking rally this year. Analysts tracking the precious metal...

Read Full Story (Page 1)COVER FEATURE

Budget 2026 has allocated over Rm700mil for tourism industry development, including Rm500mil specifically earmarked for Visit Malaysia 2026 (VM2026). While these allocations and incentives are welcome, the tourism industry must sustain momentum beyond...

Read Full Story (Page 2)Carbon tax still finding its footing

PETALING JAYA: The planned implementation of a carbon tax in the recent Budget 2026 offered little clues that industries were looking out for. Any imposition of a carbon tax is seen to increase companies’ tax burdens for critical industries such as...

Read Full Story (Page 1)Towards a secure regional grid

KUALA LUMPUR: Asean’s shared vision of power transition begins with one crucial step – a unified system plan. Tenaga Nasional Bhd (TNB) said coordination through the Heads of Asean Power Utilities/authorities (Hapua) is key to building a secure and...

Read Full Story (Page 1)Inflation on cruise control

PETALING JAYA: Malaysia’s inflation rate is expected to remain steady in September, with economists projecting headline inflation between 1.3% and 1.5%, as price pressures remain contained ahead of the Budi Madani RON95 (Budi95) targeted fuel subsidy,...

Read Full Story (Page 1)REITS set for stable growth despite volatility

JAYA: Malaysian real estate investment trusts (REITS) are expected to maintain stable performances in the near term, in spite of prevailing uncertainties. Olive Tree Property Consultants founder and chief executive officer Samuel Tan said the local...

Read Full Story (Page 2)COVER FEATURE

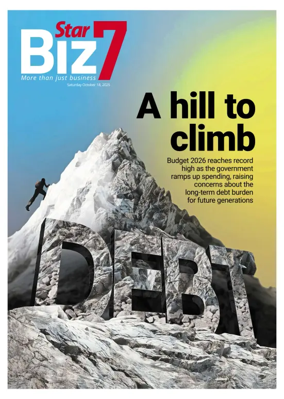

Budget 2026 reflects a government torn between two competing instincts: the need to project fiscal discipline, and the fear of the political and economic consequences of pursuing genuine fiscal reform. It is a budget that trims at the margins, not cuts...

Read Full Story (Page 2)Trade volatility hiccup?

PETALING JAYA: The re-escalation of the United States (Us)-china trade war will have an impact on the Malaysian economy although most economists are hopeful that any recent developments in the dispute can be ironed out. The latest episode in this...

Read Full Story (Page 1)Strengthening country’s carbon economy

KUALA LUMPUR: Malaysia has the opportunity to shape the regional carbon economy with the ability to grow, be inclusive and be result-based. Plantation and Commodities Minister Datuk Seri Johari Abdul Ghani said regionally, there is plenty of potential...

Read Full Story (Page 1)ACE Market listings lure in the money

PETALING JAYA: The ACE Market continues to be a favourite listing platform among companies that are seeking to raise funds and go public this year. This continues a trend that was noticed last year as funds appear to be more open now to having a stake...

Read Full Story (Page 1)Genting Malaysia privatisation offer ‘unfair but reasonable’

PETALING JAYA: Genting Bhd’s offer to privatise Genting Malaysia Bhd at RM2.35 per share is deemed “unfair but reasonable”, according to an analyst. Tradeview Capital Sdn Bhd portfolio manager Ng Tzyy Loon said the RM2.35 offer price – representing a...

Read Full Story (Page 1)Affordable housing cheer

PETALING JAYA: The stamp duty exemption extension to first-time home buyers for the purchase of property below RM500,000 is set to spur affordable housing sales and homeownership among the low to middle-income groups. The measure, announced under...

Read Full Story (Page 1)From farm to world

With Malaysia under its belt, Farm Fresh Bhd is fast becoming a regional dairy powerhouse – planting its flag in the Philippines, breaking into Cambodia almost overnight, and gaining a foothold Down Under

Read Full Story (Page 1)Bonds outshine stocks

PETALING JAYA: Net inflows of foreign funds into local equity and bond markets are expected in the fourth quarter (4Q25) with the lowering of interest rates by the US Federal Reserve (Fed), market experts say. Year-to-date, net foreign fund outflows...

Read Full Story (Page 1)Reviving growth via innovation, revenue

PETALING JAYA: The World Bank has cautioned that 2026 may be “a year of restraint” for Malaysia, as slowing global and regional growth, weaker export demand and softer domestic consumption are expected to keep economic expansion flat. World Bank lead...

Read Full Story (Page 1)Rm9.4bil spillover effect from SFO

PETALING JAYA: The Securities Commission (SC) expects the country’s single family office (SFO) scheme to generate between Rm3.4bil and Rm9.4bil in net gains to the local economy over the next two decades as Malaysia positions itself as a hub for...

Read Full Story (Page 1)